2019/20 Year end and starting 2020/21. These instructions will guide you smoothly through the process.

Note

You do not have to 'close off' 2019/20 payroll before starting 2020/21 Payroll. 2019/20 payments will still be retained in the 2020/21 version and you can still process 2019/20 pay in the 2020/21 version. Use the 'Year' drop down at the top left of the Payroll screen to swap between years. Payback is a multi-year payroll system.

Suggested year end process

It is possible to process year end in a different order to below. We suggest the following:

- Upgrade Payback to the new version following these instructions: http://www.paybackgppayroll.co.uk/Support/Downloads/Index

- Process the last payment(s) for 2019/20.

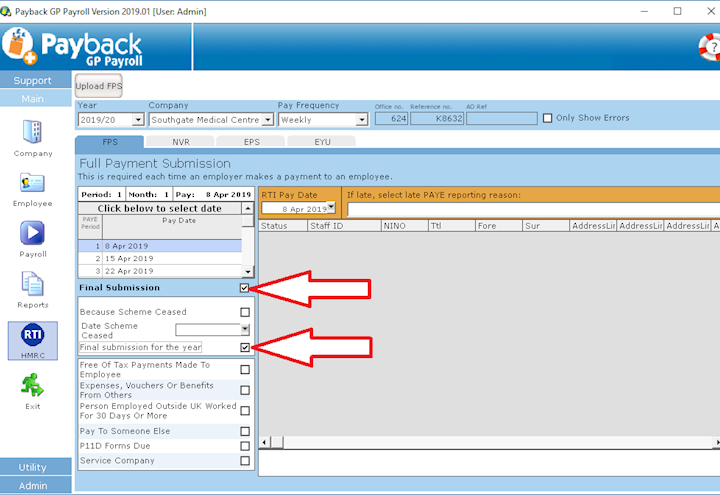

- Submit the final FPS for 2019/20. Remember to tick 'Final Submission ' at the bottom left and also tick 'Final Submission of the Year'. (see below)

- Produce P60s for your employees.

- Back up your database.

- Uplift the tax codes for 2020/21 using the Company screen> Start of Year facility.

You are now ready to continue processing payments for 2020/21

Submitting Final FPS

Remember to tick 'Final Submission ' at the bottom left and also tick 'Final Submission of the Year'.

If the date you are making the final submission is after the end of the financial year you are submitting for, you may get a warning message:

FPS is Late. Set to today's date?

Select No for this, otherwise you will get an error message from HMRC when you submit and the submission will be rejected.

Notes

Due to the current workload caused by the Covid-19 Pandemic, we have had delay the release of our online Cloud based version.

We are still working on this and expect to have it ready in the next few weeks.

Download a Free Trial

Get started with a free trial. You can process two full payments and be confident that Payback does everything you require at no risk.