Introduction

Payments and deductions are set up using a combination of Elements and Voluntary Deductions. It is possible to set up all kinds of scenarios. We have made it easier for you by providing a 'Quick Setup' facility to set up:

- Cycle to Work Scheme

- Taxsaver ticket

- Salary Sacrifice

- Illness Benefit (Sick pay)

- Maternity

- Pensions

- Property Tax (LPT)

Instructions for quick set up can be found here: Quick Setup

However, sometimes people need to set up payments or deductions that are more complex. Maybe employees are owed money from previous periods, the company is making donations or you want to enter in the Net amount and let Payback calculate the Gross etc, etc... In these cases, elements and deductions can be manually set up.

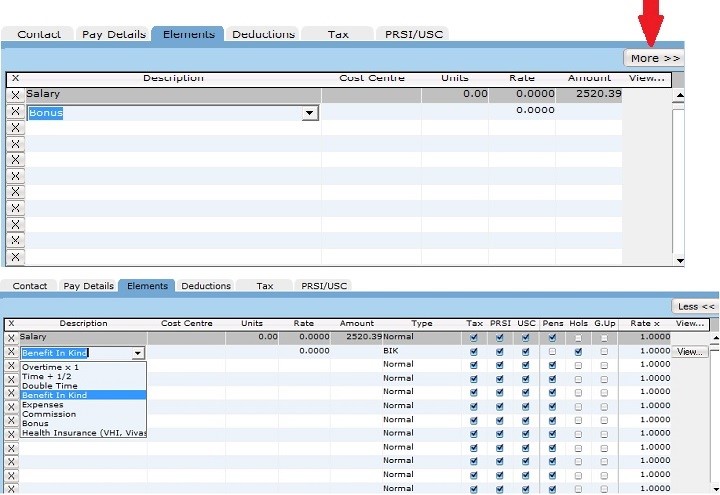

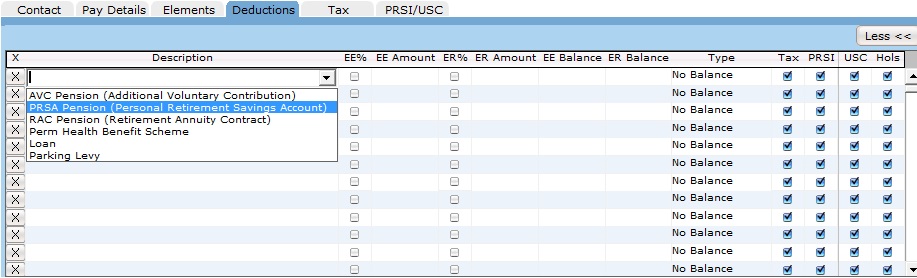

The Company, Employee and Payroll screen all have Elements and Deductions grids.

- Company Screen Elements and Deductions - These are Company specific. Use these grids to set up elements and deductions that are commonly used by your company. For example, your company may have a type of Bonus or rate that's specific to the industry. (eg, Retail might have a special Sunday hours rate or an Easter bonus etc.)

- Employee Screen Elements and Deductions - These are Employee specific. If you want the element or deduction to be applied for each pay period you process for the selected employee, set it up here. Examples are Pensions or Bike to Work scheme.

- Payroll Screen Elements and Deductions - These are Payment specific. All the elements and deductions you set up in the employee screen are copied to the Payroll screen when you process a payment for the selected employee. In the Payroll screen you can make one off adjustments to elements and deductions you set up in the employee screen. You can also add once off elements and deductions here (example would be a Christmas bonus)