Introduction

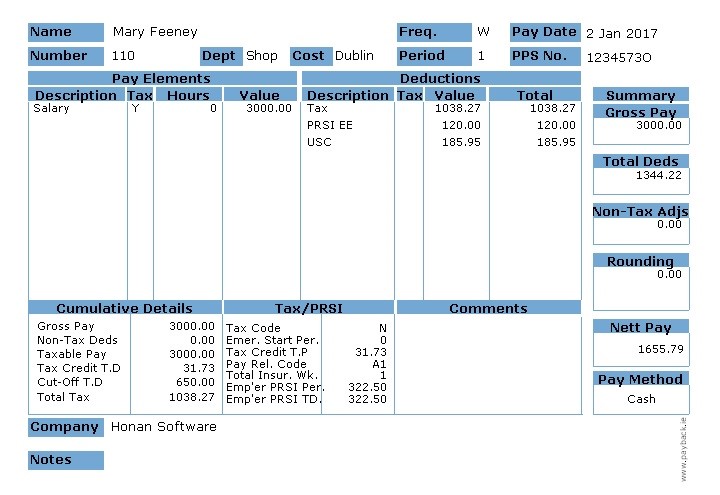

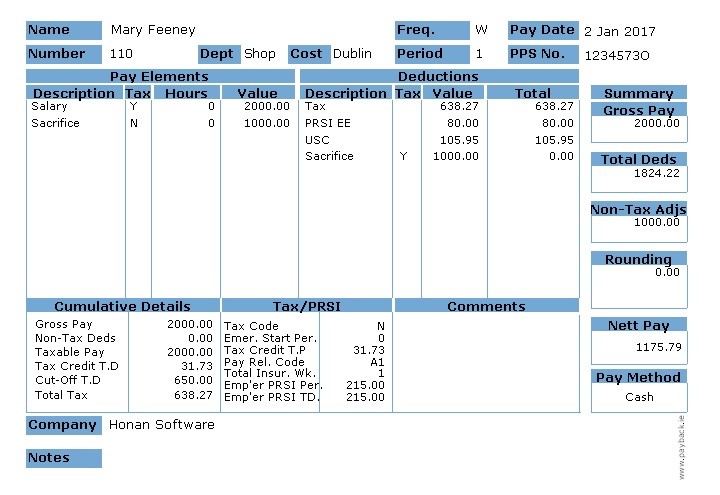

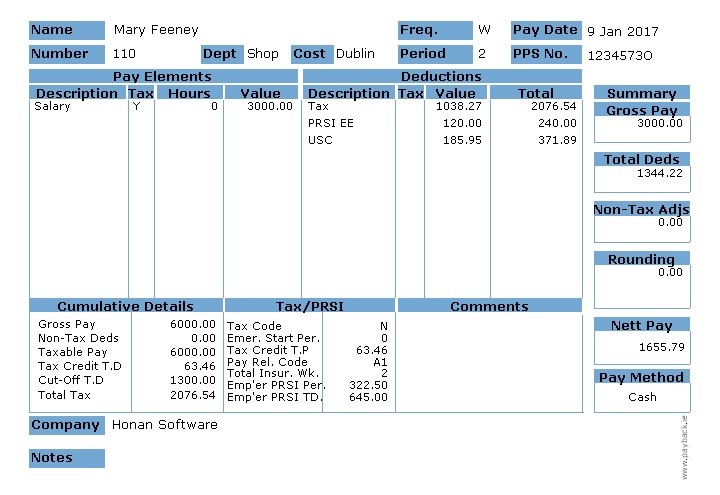

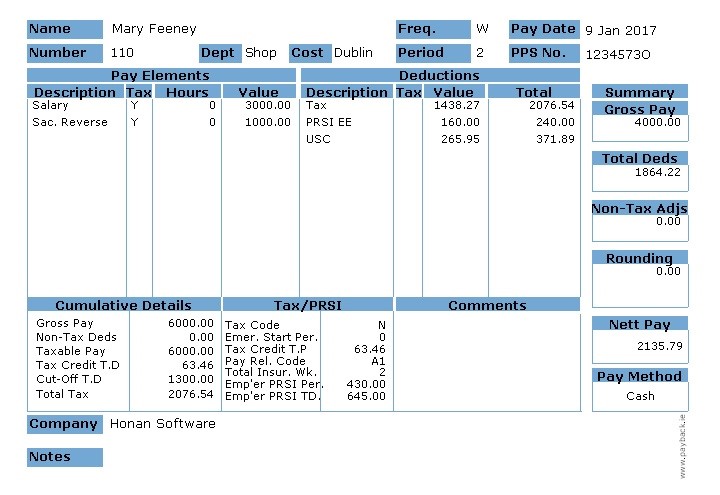

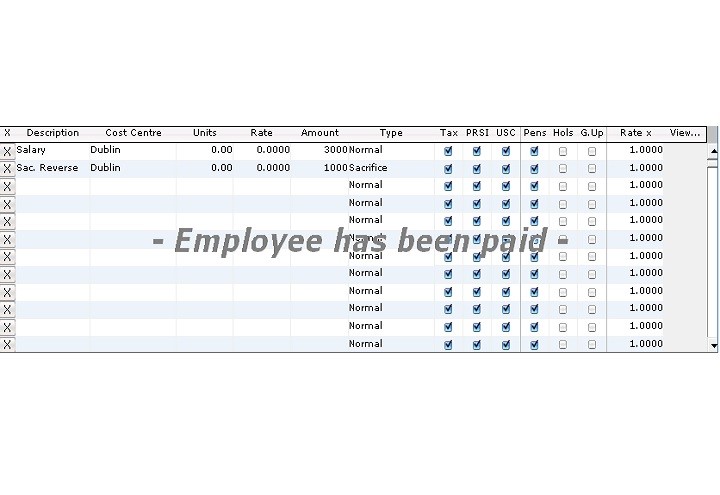

The principle is that the employee gives up, or sacrifices, a portion of their pay and then receives something in return from their employer. This has a significant tax advantage for the employee because the salary they sacrifice is pre-tax (not taken from net pay) The employee pays less PAYE, PRSI and USC.

Revenue considers the remuneration sacrificed is to be considered as an application of the income earned by an employee rather than an expense incurred by that individual's employer. (The only exceptions are the two schemes provided for in Section 21 Finance Act 2008.)

http://www.revenue.ie/en/practitioner/tax-briefing/archive/70/salary-sacrifice.html