Introduction

The Community Employment (CE) schemes is designed to help people who are long-term unemployed and other disadvantaged people to get back to work by offering temporary and part-time placements in jobs within local communities. After the placement, participants are encouraged to seek permanent part-time and full-time jobs elsewhere based on the experience and new skills they have gained while in a Community Employment scheme.

Rate of Payment can be found here:

http://www.welfare.ie/en/Pages/Employment-supports.aspx

USC

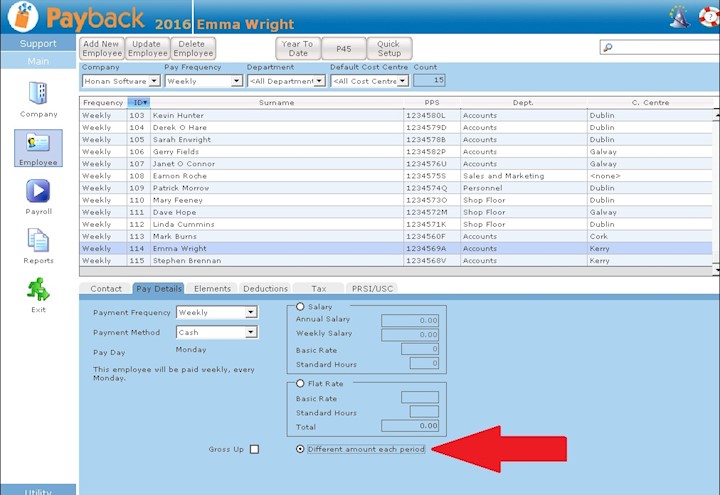

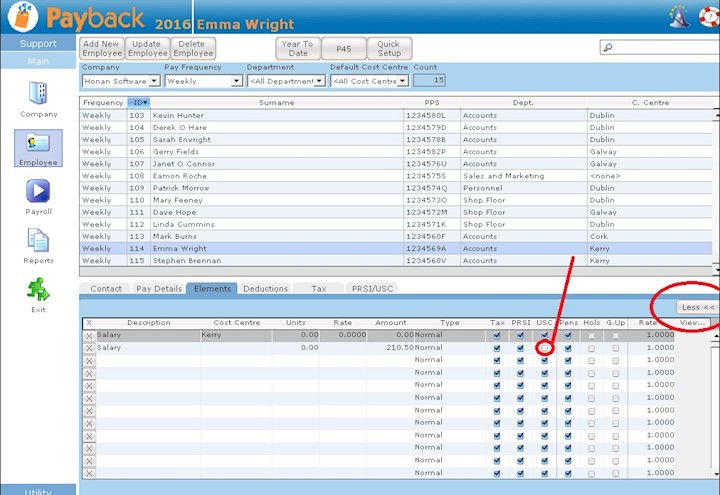

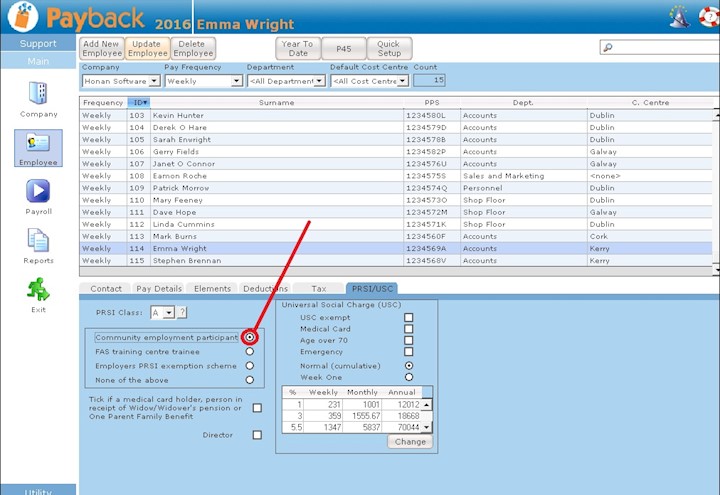

Payments made to participants on a Community Employment Scheme are social-welfare-like payments and are therefore exempt from USC. This is subtly distinct from the payments having a zero rate of USC. Revenue insist that the payment should be processed as not being liable for USC, rather than as being liable for USC (and at 0%). This means that attention must be paid to the way CE employees are set up.

PAYE

Income from any project commencing on or after 1 October 1993 is taxable irrespective of the location of the project or the participants. This means that PAYE should be processed as normal, with appropriate tax credits and standard rate cut off point.

PRSI

'Community Employment Participant' should be selected in the PRSI/USC tab so that the appropriate rate of PRSI is applied.