Introduction

To acccommodate PAYE Modernisation, we have had to make a few changes to the way some screens look in Payback. This is so that you can record and modify items, for example; the type of director or PRSI exemption reasons.

To acccommodate PAYE Modernisation, we have had to make a few changes to the way some screens look in Payback. This is so that you can record and modify items, for example; the type of director or PRSI exemption reasons.

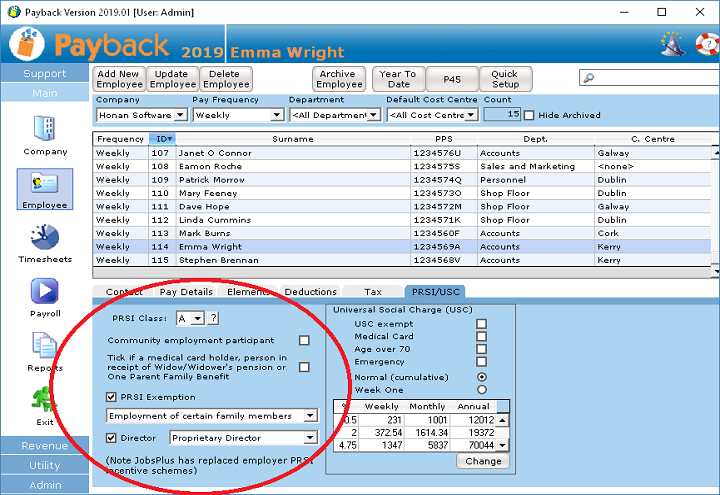

Employee PRSI/USC tab changes

Revenue now requires directors to specify what category of director they are. Directors can be either a Proprietary or Non-Proprietary Director. Employees that are exempt for PRSI now have to specify an exemption reason.

We have also removed some older PRSI categories that applied for previous years. If you need to process payroll for employees who were FAS training centre trainees or who qualified for the Employers PRSI exemption scheme, please use Payback version 2018.06

Please check that these fields are correct for all employees before uploading your Payroll Submission.

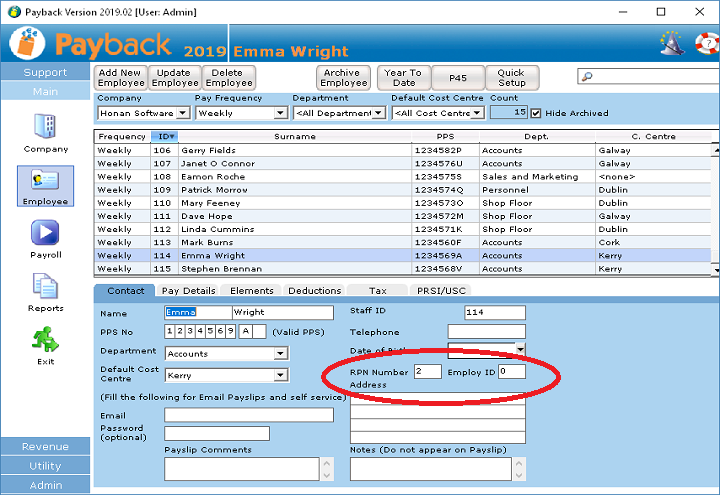

Employee Contact tab

Two new fields have been added; RPN Number and Employment ID.

Download a Free Trial

Get started with a free trial. You can process two full payments and be confident that Payback does everything you require at no risk.