Community Employment Schemes and USC

This information is correct as of 6 December 2023.

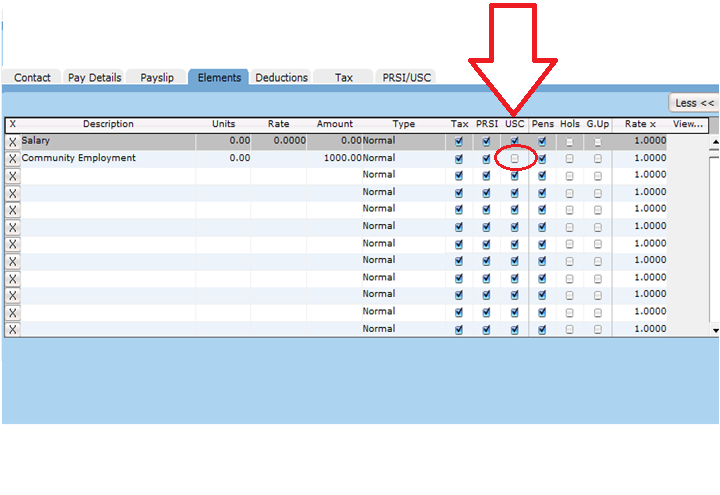

Community Employment (CE) workers payments are non-USCable. CE payments are listed under welfare like payments and exempt income. This does not mean that the workers themselves are USC exempt, it just means that the CE payments are USC exempt. The payments, rather than the participants are exempt.

A CE participant could also have other income that is liable for USC.

Revenue have advised that CE participants were not exempt from USC, just that they should be changed 0%. Their reasoning is 'A customer on a CE Scheme may not be USC exempt as they may have income

from another source which exceeds the USC threshold of €13,000'.

When submitting a CE payment to Revenue, the amounts will be:

- Gross pay for USC: €0

- USC deducted amount: €0

(Note that these amounts will be automatically filled in by Payback for the submission. The user does not enter these anywhere.)