How to check your figures

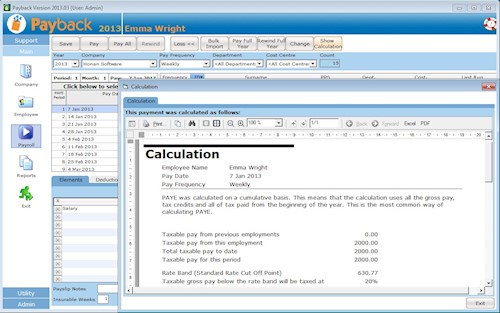

In the Payroll screen, click the 'More>>' button at the top of screen. More buttons will be displayed. Click the 'Show Calculation' button.

The calculation report shows exactly how Payback is calculating the current payment. If the calculation is not what you were expecting, the most common reasons are:

PAYE is not correct or is zero

Tax credits or Standard Rate Cut Off Point wrong or not entered (Check the Tax tab of the employee screen)

Check that you've entered the correct Standard Rate Cut Off Point and Tax Credits in the Employee Screen 'Tax' tab. Ensure that you haven't inadvertently swapped the tax credits and Standard Rate cut off point. (If you do not know this information, put the employee on 'Emergency Tax'). These figures should be the annual amount.

Previous periods skipped (The 'Pay' button should be clicked for all periods)

Are you clicking the 'Pay' button at the top of the screen to process the pay for the employee? You have to click this button to process the Pay for the employee for the current period, before moving onto the next week or month.

Year to Date figures from previous payroll system entered incorrectly

Did you change Payroll system from another software package, or paper based system mid year? - If you did, then please ensure that you've entered in all the correct information in the Year To Date details in the employee screen.

PAYE is zero and it should not be

- Check that you have not incorrectly entered too much standard rate cut off point or tax credits in the Tax tab in the employee screen.

- Is the PAYE column ticked in the Elements' grid? - you may have to click 'More>>' to see this

- Is the employee earning enough to pay PAYE?

PRSI is not correct or is zero

This is the least likely problem to happen because PRSI is calculated on a week one basis. If the PRSI figure is not what you are expecting, make sure the you've selected the correct PRSI class in the employee screen, PRSI/USC tab. The vast majority of employees are class 'A'. proprietary directors are generally class 'S'.

If PRSI is calculated as zero, make sure that the PRSI check box is ticked in the elements' grid. You may have to click the 'More>>' button at the top right of the grid to see this. If PRSI is still zero and it should not be, make sure that 'exclusion order' isn't incorrectly ticked in the Tax tab of the employee screen.

USC is not correct

Cut off Point Vs Bands:

When entering USC rates in Payback, please use Cut Off Points and not Bands. For Example, these are Cut off Points (USE THESE):

| Percent | Cut Off Point |

|---|---|

| 2% | €10036 |

| 4% | €16016 |

| 7% | Balance. |

These are Bands (DO NOT USE THESE):

| Percent | Band |

|---|---|

| 2% | €10036 |

| 4% | €5980 (This band is the difference between 4% figure and 2% figure, 16016-10036) |

| 7% | Balance. |

Always use Cut off points, and not Bands when entering USC rates into Payback. The 4% figure is generally greater than the 2% figure) Revenue have introduced confusion by their use of terminology. P2C files and paper certificates use Cut Off Points. Revenue helpdesk and other internal systems use Bands.

Rounding cut off points

You may have entered: 2% = €837 instead of using: 2% = €836.34

Employees paid lower than €13,000 are paying USC

You may also notice that employees who are paid less than €13,000 are sometimes liable to USC.

Exemption Amounts:

| 2012, 2013 & 2014 | 2015 | 2016 & 2017 |

|---|---|---|

| Where an individual's total income for a year does not exceed €10,036 | Where an individual's total income for a year does not exceed €12,012 | Where an individual's total income for a year does not exceed €13,000 |

Payback does not automatically apply this exemption. It is not a bug, this is by design.

Revenue have advised us that only the rates as advised on the P2C (Tax credits certificate) should be used. Users should not apply exemptions or reduced rates (Medical card holders etc) without a valid P2C. The onus is on the employee/pensioner (not the employer), to advise Revenue if their annual earnings will exceed the exemption threshold.

We understand that this will probably cause problems for employers. We have provided the facility for employers to make employees USC exempt. To make an employee USC exempt.

- Go to the employee screen.

- Select the employee you wish to make USC exempt.

- Click the PRSI/USC tab.

- If the 'USC Exempt' check box is visible, tick this and click update employee.

- If you can not see a 'USC Exempt' check box:

- Click the 'Change' button under the USC rates grid and a new screen will appear.

- Click 'Standard Rates' in the new screen. Click 'Yes' when the message 'Clear USC Rates and use standard rates' appears.

- The 'USC Exempt' should now be visible. Tick this and click 'Update Employee'.

USC is zero and it should not be

- Check that you have not incorrectly ticked 'USC Exempt' in the PRSI/USC tab in the employee screen.

- Is the USC column ticked in the Elements' grid? - you may have to click 'More>>' to see this

- Is the employee earning enough to pay USC?

The figures in the P35 do not match

Those differences are due to the way the rounding works. The P35 report rounds down the figures to the nearest Euro for each employee. Using the P35 Breakdown report, the tax from the P35 is 10477. If you include the cents for all payments, it is 10482.44

For the totals at the bottom, each employee's tax and prsi is rounded down and totalled. The P35 report does not have cent for each employee Eg, for two employees

| Employee | Tax | PRSI |

|---|---|---|

| Mary | €5530.56 | €2402.23 |

| Johnny | €2023.40 | €1032.89 |

Rounded

| Employee | Tax | PRSI |

|---|---|---|

| Mary | €5530 | €2402 |

| Johnny | €2023 |

€1032 |

Totaled:

| Tax | PRSI |

|---|---|

| €7553 | €3434 |

The P30 cent amounts are not rounded in this way, so they'll be larger values.

Notes

We often get customers querying if PRSI, PAYE, USC or Income levy are being correctly calculated. Payback has undergone extensive testing. We use the following methods to test calculations:

- In house testing with our technicians. Calculations are manually calculated.

- In house testing, comparision with other products.

- Beta testing with a selection of existing customers who have elected to be beta testers. (The PRSI and PAYE algorithms have been in the wild since 2004, so that's a huge number of payslips!)

Some of the more complex calculations, especially for PRSI, often give different results depending on the method of calculation used. We have noticed that different payroll products will often give different results, especially when various ceilings are breached. Sometimes these differences can be significant, especially for highly paid monthly employees.

We are fully confident that Payback calculates the figures correctly.

In the past, when customers have queried the results, our support technicians have spent hours manually calculating PRSI, USC, Income Levy and PAYE, this always confirms that Payback is correct. Often the customer is using incorrect rates or making incorrect assumptions. Sometimes the customer is using an equally valid, but different method to calculate figures. Due to the time consuming and resource intensive nature of these queries, we will no longer be doing this.

The USC FAQ is here: http://www.revenue.ie/en/tax/usc/universal-social-charge-faqs.pdf

The Income Levy FAQ is here: http://www.revenue.ie/en/tax/income-levy/income-levy-faqs.pdf

PRSI Rates can be found here: http://www.welfare.ie/en/downloads/SW14.pdf