Introduction

During 2012, Auto-Enrolment was phased in starting with the largest employers. By 1 Feb 2018, all eligible workers should have been automatically enrolled in their employer's pension scheme.

It is now compulsory for employers to automatically enrol their eligible workers into a pension scheme with the employer also paying money into the scheme. Employees can opt out of the pension if they wish. If employees opt out within one month of being automatically enrolled, any contributions they have already made must be refunded as if they had never joined.

Eligible employees must be opted in every three years. An employee is eligible if:

- They are aged between 22 and the State pension age

- Earn over the earnings threshold, and

- Work, or ordinarily work in the UK and have a contract of employment (i.e. so is a worker and not a self-employed contractor), or who have a contract to provide work and/ or services personally (so can’t sub-contract to a third party)

The 2019/20 earnings thresholds are:

| 2019/20 | Annual | Week | Fortnight | Four Week | Month |

|---|---|---|---|---|---|

| Lower level of qualifying earnings | 6136 | 118 | 236 | 472 | 512 |

| Earnings trigger for automatic enrolment | 10000 | 192 | 384 | 768 | 833 |

| Upper level of qualifying earnings | 50000 | 962 | 1924 | 3847 | 4167 |

Previous years can be found here: Pension Regulator AE Earnings Thresholds

Calculating the Contributions

Both the Employer and Employee should contribute a (minimum) percentage to the employee's pensionable earnings to the pension scheme. The minimum contribution rates are:

| Year | Employer | Employee | Total |

|---|---|---|---|

| 2019/20 | 3% | 5% | 8% |

| 2018/19 | 2% | 3% | 5% |

| 2012 to 2018 | 1% | 1% | 2% |

Example

An employee is on £15000/year. As they are being paid over £10000, this is enough to trigger auto-enrolment.

If you are using Qualifying Earnings, the lower level of qualifying earnings (6136 for 2019/20) is not included in the calculation. In this case the employees qualifying earnings is 15000-6136 = 8864

You should then base the contribution on this amount. For 2019/20, the employer will contribute 3% of 8864 and the employee will contribute 5% of 8864.

Employer annual contribution: £265.92

Employee annual contribution: £443.20

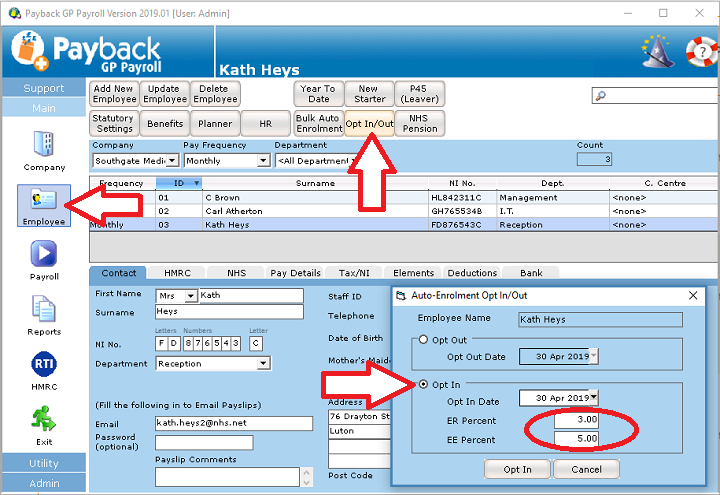

Individually enrolling employees

If you do not have too many employees to enrol, you can easily individually enrol them.

In the Employee screen, select the employee and click the 'Opt In/Out' button at the top of the screen. The Auto-enrolment dialogue will appear. Select the 'Opt in' option and ensure that the rates are correct. Note that the rates shown above are minimum rates. You can enter higher percentages.

Click the Opt In button

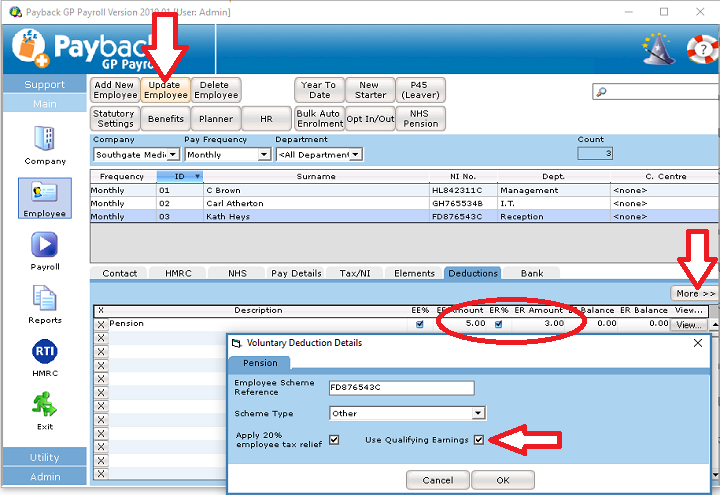

Payback will automatically set up the pension for the employee. If you click the 'View...' button at the left of the deductions grid, you will see that the rates are the same as what was entered in the opt in dialogue. Use Qualifying Earnings is automatically selected as this is the most common way of calculating pension contributions.

If you are happy with this deduction, click 'Update Employee' to save it.

The employee has now been successfully enrolled.

Notes

- The 'Apply 20% Employee tax reflief' check box will take 20% off the earnings before working out the Employee contribution. Please check that this applies to your employee and pension scheme

- 'Use Qualifying Earnings' check box will take off the Lower Earnings Limit before calculating both the Employer and Employee contributions.

- The Lower Earning Limit deducted is for the current pay period and frequency and is not cumulative.