Introduction

If a new employees starts in your company, their employment will have to be registered with Revenue.

You can do this from within CloudPay by requesting a Revenue Payroll Notification (RPN). This guide show you how to do this.

More information about hiring new employees can be found here: https://www.revenue.ie/en/employing-people/hiring-an-employee/index.aspx

Enter employee details

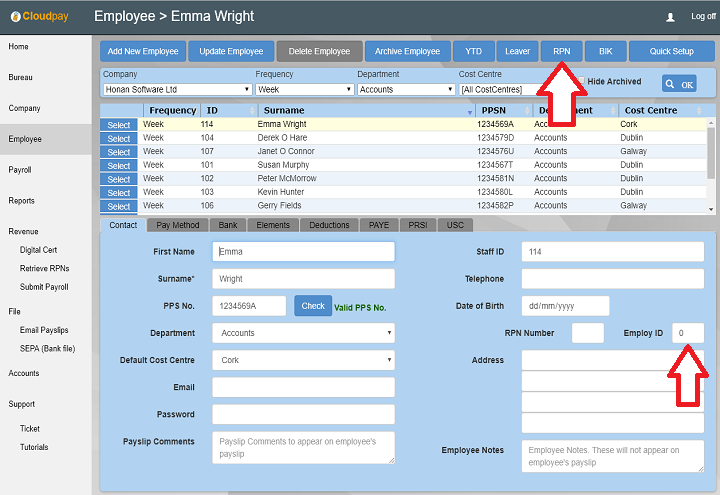

In the employee screen, please make sure that you've entered the following:

- PPS Number

- Employ ID

- Start Date

You will need the PPS Number and Employ ID to request the RPN (Employee tax details) from Revenue.

If you do not know the PPS Number of the employee, you will not be able to request an RPN.

We recommend using a 0 for the Employ ID (employment ID). This is used to identify the employment for this employee. If they have previously worked for you before in the current year, you should change this to 1 (or 2 if they've worked for you twice before etc...)

The Start date can be found in the PAYE tab. You do not need the start date to request the RPN, but you'll need it for the first payroll submission (PSR) for this employee.

Requesting the RPN

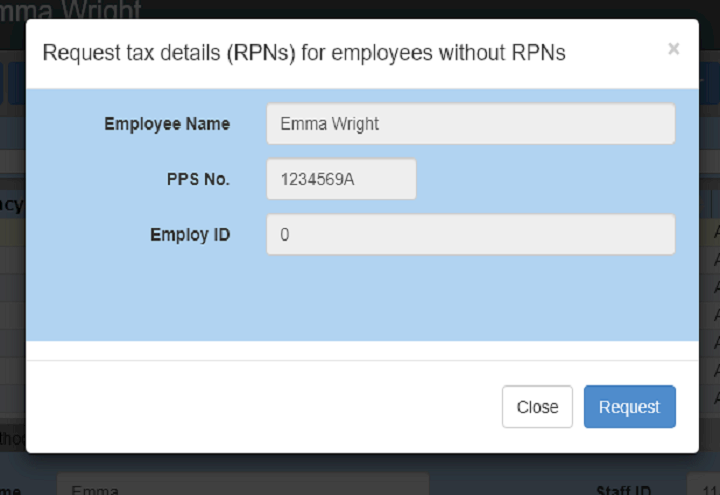

When you are happy that the relevant fields are filled, click the RPN button at the top of the screen

This will register the employment with Revenue and request their tax details.

The next time you retrieve RPNs in the https://www.cloudpay.ie/Revenue/RequestRPN screen, then employee should be listed with the Employment ID that you specified.

Notes

- If after you have requested the RPN, then employee is still not appearing the in https://www.cloudpay.ie/Revenue/RequestRPN screen, Revenue may still be processing the employee and not yet updated the RPNs. If after one or two days the details still do not appear, log into ROS and check the status of your request.

- If no RPN is available for the employee, Revenue instruct that you must tax the employee on an Emergency Basis. This can happen if you do not have a PPS Number for the employee.

- If you do not know the PPS Number of the employee ID, leave this blank and instead enter a Staff ID. This is also known as an employer reference and is a staff identifier made up by the employer. Examples of a Staff ID are numbers (such as 1, 2 3...) You can use what ever staff ID you like. Entering a staff number will make sure that the next PSR (payroll submission) will go through.

- You do not need the start date to request the RPN, but you'll need it for the first payroll submission (PSR) for this employee.

- You will not be able to request an RPN if you do not know the PPS Number for the employee.