Introduction

The TWSS subsidy was treated for tax like a social welfare payment. This meant that it was not taxed through payroll, like salary is.

This means that many employees may now owe tax incurred through TWSS.

Revenue have advised us that to pay this subsidy, employers should submit a payroll submission for a pay date of 25 Dec 2020, so that it falls in the 2020 tax year. 25 Dec 2020 was chosen as not many submissions go through for that pay date.

The employee is liable for both PAYE and USC, so the following two fields should be filled:

- IncomeTaxPaid

- USCPaid

Everything else should be left blank. This utility will allow you to submit a PSR with these values filled.

Revenue are permitting these amounts to be paid without incurring benefit in kind.

The deadline for this is 30 Sep 2021.

Paying this is optional for Employers. More information can be found here:

https://www.revenue.ie/en/tax-professionals/ebrief/2021/no-0972021.aspx

Submitting the liability PSR

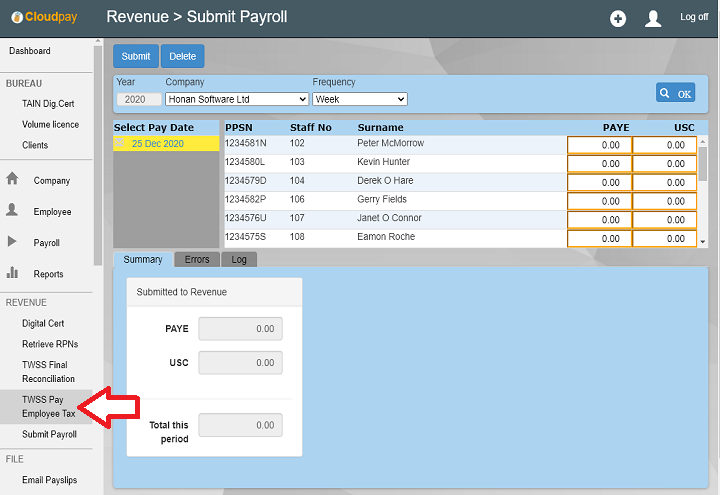

On the menu Select TWSS Pay Employee Tax, under the Revenue Section.

The pay date is set to 25 Dec 2020, and you can not change this. All employees are listed, regardless if they've left, have not started, or received subsidy payments. This is to allow maximum flexibility.

- Select each relevant employee by click on the grid.

- Enter the PAYE and USC liabilities you wish to pay in the orange boxes

- When you have finished, click the Submit button at the top of the screen.

The Payroll run reference will have TWSSTAX_ prefix so that you know that this was for the TWSS tax liability. When you submit, your December 2020 liability will increase in ROS allowing you to pay the extra.

NOTE: Only enter details for those employees you wish to pay the liability for.

Download a Free Trial

Get started with a free trial. You can process two full payments and be confident that Payback does everything you require at no risk.