Introduction

The new Employment ID is used in the following cases:

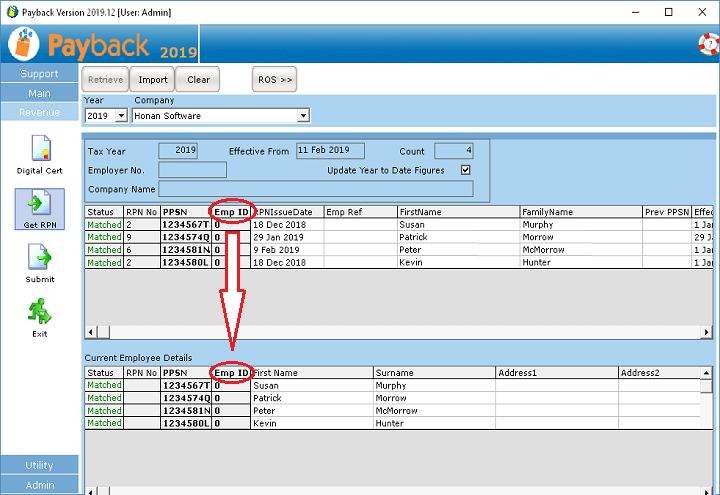

Concurrent employments

When employers have the same employee twice on their payroll, with two separate employments. Its main purpose is so that the correct RPN can be allocated to the correct employment for the employee.

This scenario does not happen very often, with most employers combining the salary. In practice, the vast majority of users will have no use for the Employment ID as this condition is unlikely, and can safely ignore it.

Consecutive employments

If an employee leaves employment and then is re-employed during the same tax year, then they should be allocated a new, different employment ID to their previous employment.

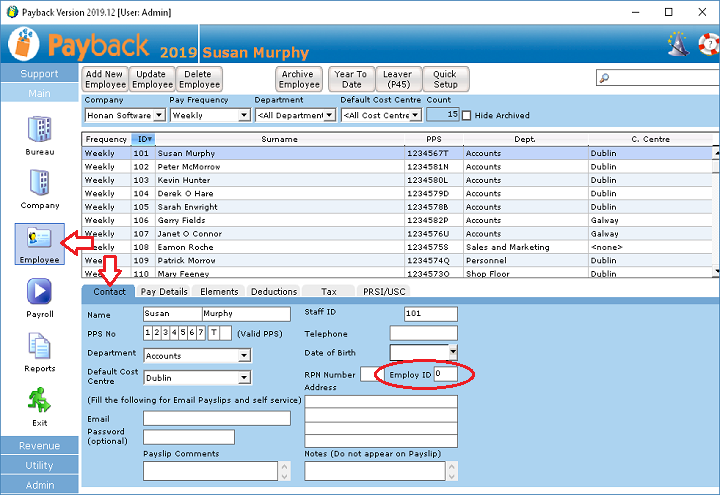

How Employment IDs are set up

Employment IDs can be allocated by one of these methods:

- When you submit a payroll submission in the Revenue>Submit screen, when the Employment ID entered in the Employee screen>Contact tab Employ ID field has been changed since the last submission.

- Creating a New RPN request manually via ROS.ie, using a different Employment ID

- A new employment can also have a blank employment ID if it was set up through jobs and pensions by the employee.

Note: You should not change an employment ID for a current employment once an Employment ID is notified to Revenue. Each time a payroll submission is made with a different or new Employment ID a new employment is created on Revenue systems for that employee.

You may find that there are duplicate RPNs for the same employee, even if this wasn't your intention. These can be resolved by following the instructions in this document:

https://www.revenue.ie/en/employing-people/documents/pmod-topics/duplicate-rpns.pdf